What to Expect When Times Get Tough…

By Nigel Dennis and David Lunn, BidWrite Co-Founders

As the economic implications of the global pandemic are becoming clearer, the majority of businesses are scrambling to assess the impact on their top and bottom lines. Others are scrambling simply to survive.

In this first of two articles, BidWrite co-founders Nigel Dennis and David Lunn share their views on what to expect from buying organisations during these uncertain times and the implications such behaviours have for contractors and suppliers.

These views have been shaped by more than 60 collective years’ experience on both the seller and buyer side of the tendering process.

Expected tendering behaviour of buying organisations

The first question to ask about tendering in this environment is whether it will keep happening.

There’s no doubt that the current situation is serious and to a large degree, uncharted territory for the vast majority of us. But if the past is of any use, our experience of working through various economic downturns such as the GFC leads us to believe that buying organisations, especially larger ones, will likely respond along the lines we have seen before.

How quickly and deeply this response happens will, at least in part, be influenced by two things: the extent and pace of the government economic stimulus measures that are being progressively implemented, and the evolving concept of business ‘hibernations’.

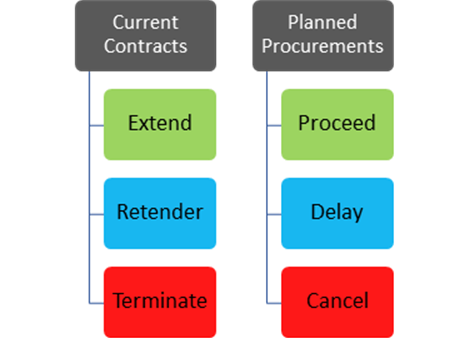

Approaches to current contracts and planned procurements

So while it’s difficult to predict exactly how this play out, assuming buying organisations adopt ‘typical’ approaches, we can expect:

- For Current Contracts: Reviewing all existing deals and deciding whether a negotiated contract term extension (for expiring contracts) is a more prudent measure than re-tendering or, for continuing contracts, establishing whether terminating for convenience and/or retendering is likely to improve near term cost or reduce supply chain risk.

- For Planned Procurements: Reassessing current planned spend to determine if projects need to proceed, can be delayed or, in the worst case, cancelled. It’s reasonable to expect a focus on discretionary expenditure, and questioning projects that don’t have a compelling ROI or activities that don’t address short term priorities/issues.

Government reticence to slow down

One positive aspect is that in order to generate economic stimulus, governments of all levels will be very reluctant to curb their sourcing activities. Thankfully we are seeing evidence of this already. Government contracts provide business stability and cash flow and, critically, keep people in employment.

And although it may not provide immediate reassurance, if planned spend is cancelled or delayed, there is likely to be a wave of buying and tendering activity once more normal business conditions return.

Implications for contractors and suppliers

Having examined likely buyer behaviour, what are the implications for providers of goods and services? Summarised, the nett effect of expected buyer behaviour means that contractors and suppliers need to prepare for:

- Tougher Renegotiation: Renegotiating existing contracts with current clients doesn’t just happen in times of crisis. But in this environment, be prepared for vigorous negotiation. It’s also worth remembering the old adage that ‘a bird in the hand is worth two in the bush’. Hopefully this time around contractors and suppliers won’t be the recipients of too many ‘times are tough’ cost down letters but, if they are, buyers will remember those prepared to recalibrate contract terms through reasonable give and take.

- Improvement Expectations for Recompetes: If buyers retender expiring contracts, they will certainly be looking for innovation and improved value. Locking in the status quo probably won’t cut it.

- Greater Competition: For a time, it’s rational to expect that fewer new opportunities will exist. This means that contractors and suppliers will find themselves facing a situation of reduced demand and greater potential competition. The need to re-win existing contracts, in this context, will be paramount. Potential new opportunities will be hotly contested.

- A Rebalancing of Value: Supply chain vulnerability is always of concern to buying organisations. This current pandemic dramatically exacerbates this issue, especially noting border controls and access restrictions, as well as potential inefficiencies while organisations adjust to new patterns of ‘work’. This means that, in many markets, cheapest price is unlikely to be a sole motivator. As a contractor or supplier, it’s a good time to be reviewing and communicating how you will address delivery and supply chain vulnerability concerns and ensuring the right ‘value’ conversations are taking place.

What to expect

It’s clear that the current situation is having, and will continue to have, serious economic consequences. It’s also clear that this will flow through to tendering activities in one form or another.

Despite it being too early to see exactly what this will look like, we hope our observations provide a practical perspective, allowing suppliers to make a clear-sighted assessment of what to expect from buyer organisations, as well as consider some of the implications that can help guide their own response during these uncertain times.

RELATED BLOG: Our next article provides practical advice about how companies can use spare capacity or time to better prepare themselves to win, be ready to win, or retain more contracts through the tendering process. When times get tough, the tough get tendering.